The Dollar Is Facing an End to Its Dominance

…

The Dollar Is Facing an End to Its Dominance

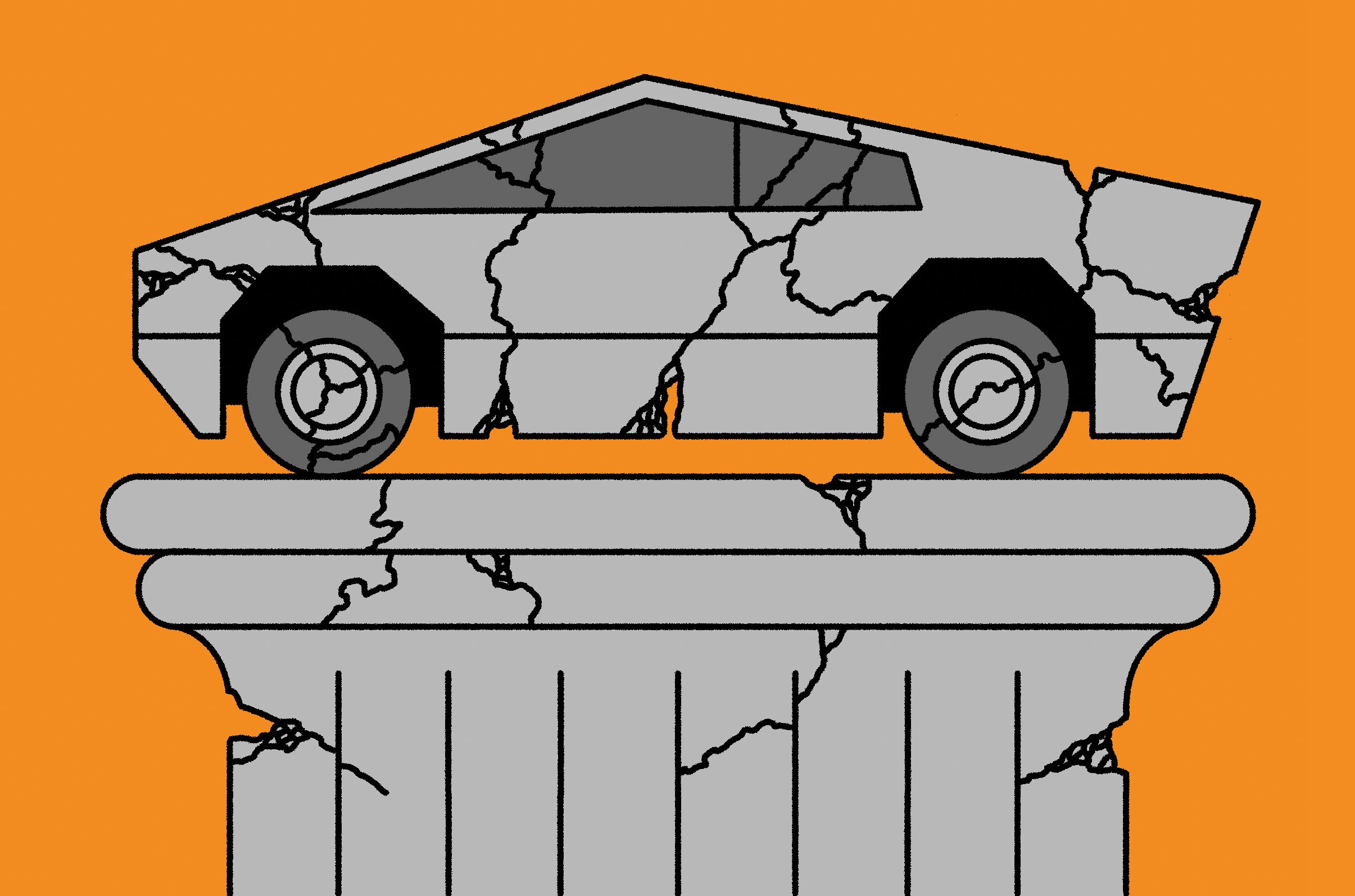

For decades, the US dollar has been the world’s dominant reserve currency, used in global trade and finance. However, recent economic and geopolitical shifts have raised concerns about the future of the dollar’s supremacy.

The rise of emerging economies like China and India, along with the growing influence of cryptocurrencies, has led to speculation that the dollar’s reign may be coming to an end. Countries are increasingly seeking alternatives to the dollar, such as the euro, yuan, and digital currencies.

The US’s massive trade deficits and ballooning national debt have also put pressure on the dollar. Investors are becoming wary of holding large amounts of US currency, leading to a decline in the dollar’s value.

Central banks around the world are diversifying their reserve holdings away from the dollar, signaling a shift in global economic power. The International Monetary Fund has called for a new global reserve currency that is more stable and transparent than the dollar.

As the dollar’s dominance wanes, countries are exploring alternative payment systems and currencies to reduce their dependence on the US. This could have far-reaching implications for the global economy, financial markets, and geopolitical relationships.

While it is unlikely that the dollar will be replaced as the world’s primary currency overnight, the signs of its decline are becoming increasingly apparent. The US will need to address its economic vulnerabilities and restore confidence in its currency to maintain its position in the global financial system.

Overall, the dollar is facing an uncertain future as new economic forces reshape the global financial landscape. It remains to be seen how this will impact the US economy and its standing in the world.

As countries and institutions adapt to a changing financial landscape, the dollar’s dominance may be coming to an end, signaling a new era in international finance.