The VC Funding Party Is Over

The VC Funding Party Is Over

In recent years, the tech industry has been riding a wave of unprecedented success fueled by an influx of venture capital funding. Startups were popping up…

The VC Funding Party Is Over

In recent years, the tech industry has been riding a wave of unprecedented success fueled by an influx of venture capital funding. Startups were popping up left and right, and investors were eager to throw money at any promising idea. However, it seems that the party may be coming to an end.

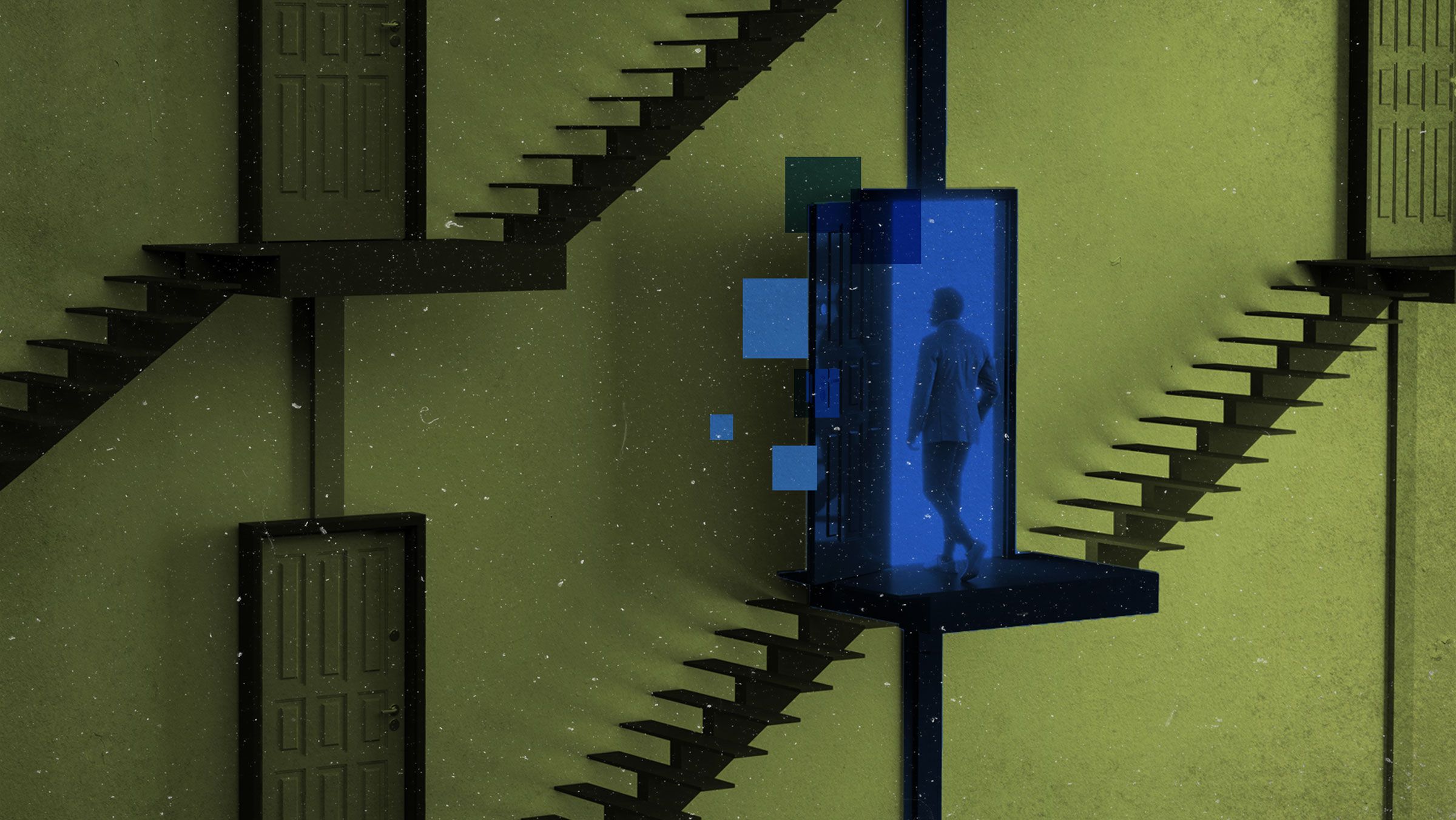

As more and more startups fail to deliver on their promises, investors are becoming increasingly wary of where they put their money. The once sky-high valuations of companies are now being called into question, and many are beginning to wonder if the bubble is about to burst.

With the rise of high-profile failures like WeWork and Uber, investors are starting to demand more accountability and transparency from the companies they fund. Gone are the days of throwing money at any idea that sounds good on paper; now, startups must prove that they have a viable business model and a path to profitability.

This shift in attitude has left many startups struggling to secure the funding they need to survive, and some are being forced to shut down as a result. The days of easy money and endless rounds of fundraising are over, and companies are now being forced to tighten their belts and focus on making their businesses work.

While this may spell trouble for some, it also presents an opportunity for startups to refocus on what really matters: building a sustainable business that can stand the test of time. By putting a greater emphasis on revenue generation and profitability, companies can weather the storm and emerge stronger on the other side.

Ultimately, the VC funding party may be over, but that doesn’t mean the end of innovation in the tech industry. By taking a more measured approach to investing, both startups and investors can ensure a more stable and sustainable future for the industry as a whole.